Are you currently faced with the challenge of having a dated manual invoicing process and legacy IT systems along with increasing customer demand and complexity? If so, you’re not alone. SMBs in every industry and region are being challenged to innovate, pushed to do more with less, and forecast for the months and years to come differently than ever before. With so many employees working remotely now, they are forced to balance their work life with other dependencies and priorities which subsequently means the invoicing process has slowed down- both on the delivery and payment side. These archaic processes directly impact your company’s financial health. As a result, your business is faced with the inability to scale and be agile in a rapidly changing world we now live in. As an economic buyer, your eye is always on the money, where it goes, how long it takes to come in, etc. This is why you can no longer drive your business to a disadvantaged position.

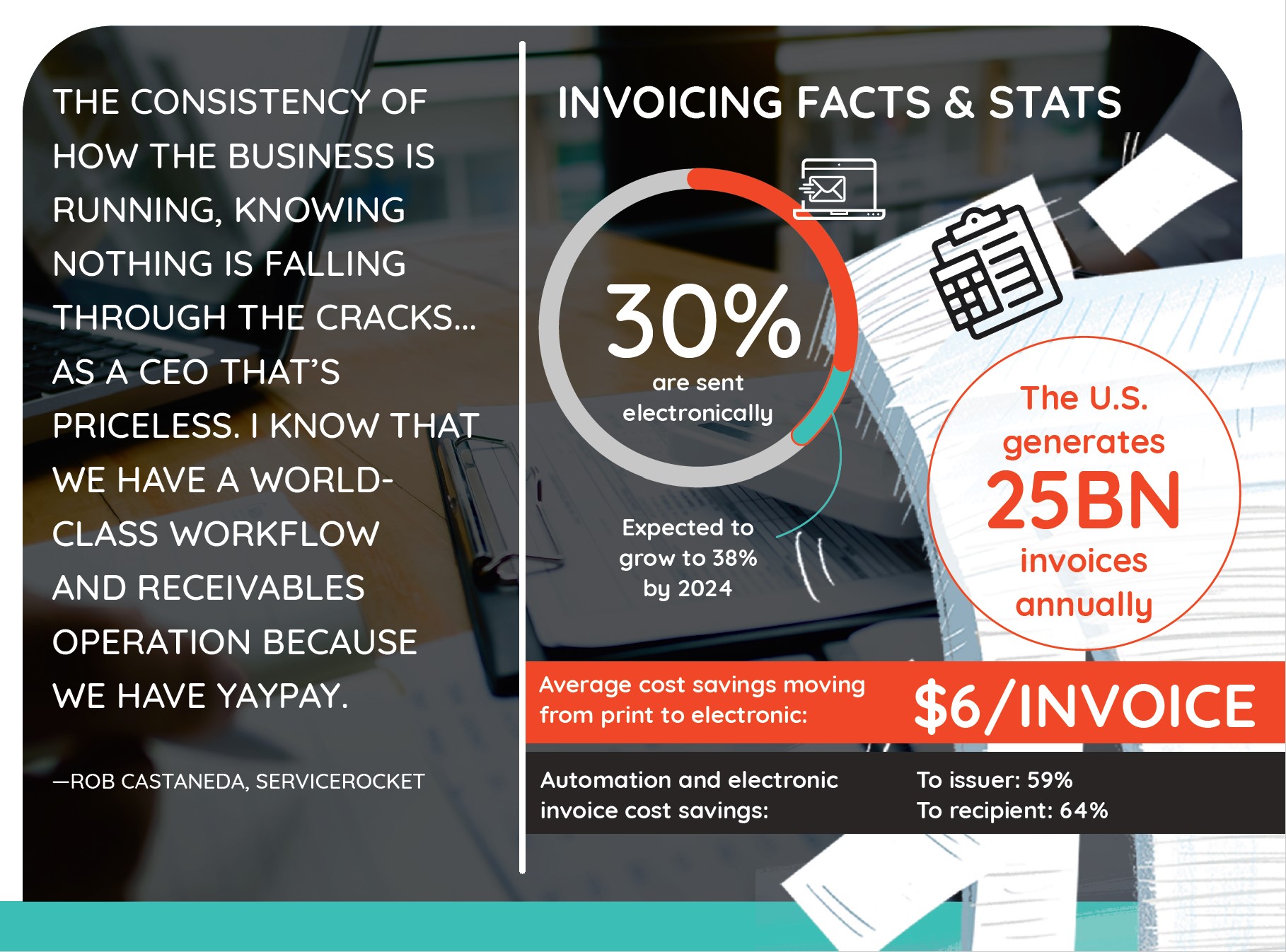

Invoicing is the lynchpin of the order to cash process. It is the single most important document that drives payment. The impact to the business when this part of the process fails can be damaging to the company’s health. The timeliness of invoices delivered has a direct impact on the timeliness of payment received. The accuracy of invoices also adds to the cost of invoicing by requiring additional time and man hours to correct errors. Both timeliness and accuracy impact customer satisfaction, as customers do not wish to spend time demystifying their invoices and struggling with channels for making payments. In the State of ePayables 2019 report, Ardent Partners reported that manual processes in invoicing and time spent correcting errors can more than triple the cost of issuing a single invoice.

CFO.com provided some data on the cost of manual invoice processing from the AQPC database that’s enlightening and frightening at the same time. Of the 1,485 organizations reporting data on this measure to APQC’s database, the bottom 25% are spending $10 or more per invoice processed. (See graph below.) The best performers — those who rank among in the top 25% on this measure — can do the same task at a cost of $2.07 per invoice or less. That’s nearly five times less than the organizations in the bottom quartile. At the median are the organizations spending $5.83 to process an invoice, or a bit more than double what the best-performing organizations spend to perform the same process.

According to PYMNTS.com, one 2019 study found that sixty-three percent of companies considered reducing their invoice processing costs a priority; this may indicate a growing frustration with such costs. Finding ways to quickly finalize invoices has even more importance during the pandemic, with many freelancers finding themselves facing financial strain from dwindling job opportunities as well as a lack of timely support from government programs such as Pandemic Unemployment Assistance (PUA) in the U.S.

Access to data and analytics will go a long way.

Customer portal: an online portal through which customers can self-serve will improve customer communications and accelerate cash flow. Customers with the ability to check their invoices on their own time, flag issues for dispute or pay through electronic channels will respond more quickly and take up less of the AR team’s limited resources.

Internal dashboard: with immediate access to customer account information, AR and customer support teams can quickly help customers with questions and disputes. Cutting back time to resolve problems accelerates the payment process and leaves customers feeling important to the business.

Stop the manual data entry madness. Automation in the invoicing process can take significant time and labor out of the process, resulting in cost reductions, error reductions and faster payments. Key areas for automation are:

- the creation of invoices, leveraging multiple data sources

- delivery of invoices through email, online portal or postal mail

- issuance of payment reminders

- acceptance of payment, via ACH, bank wire or credit card

Bring your customers on the electronic journey. If you’re going to move to electronic invoicing, online portals and other forms of automation in your invoicing process, it’s critical that you bring your customers along on the journey. A communication plan is necessary to ensure your customers are aware of any process changes you’re making, new options available to them, and what to expect next. Customer support and marketing teams should work closely together to over-communicate any new processes and features, providing an easy and pleasant transition for customers.

Use the data you’re collecting. The ability to quickly access and analyze reports regarding DSO, late payments, and errors will help AR teams more efficiently manage the invoicing process and prioritize activities.

INVOICING